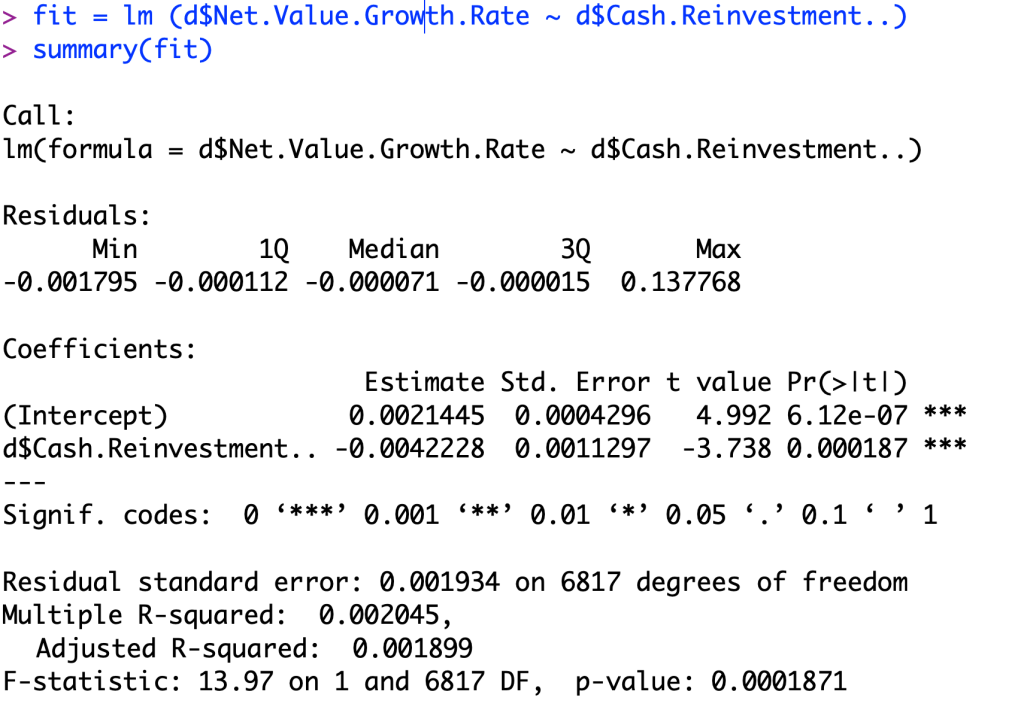

To build my linear regression model to predict a continuous variable, I used cash reinvestment % to predict Net Value Growth Rate. This was done to see if there was a correlation between the how much money a company reinvests into its business, and how much it grows.

The code that I inputted into R is as shown below:

After looking at this output, we can tell for every unit precent increase in the data, we see that if a company invests no money into the company, they are on average increasing in net value by 0.21% each year (the intercept). This seems to be very low for an average company. Now looking at the coefficient of our linear regression model line, we see that for every 1 unit (100%) increase there is a negative .0042 unit (0.42%) decrease (the slope of the linear regression line). This is highly irregular of a business and I will look into this more.