For this blog post, we will be making a logistic regression model. For this I will be predicting the binary variable of public record of bankruptcy using borrower’s monthly debt to monthly income ratio. I will also use the revolving line of credit utilization rate to predict this as well.

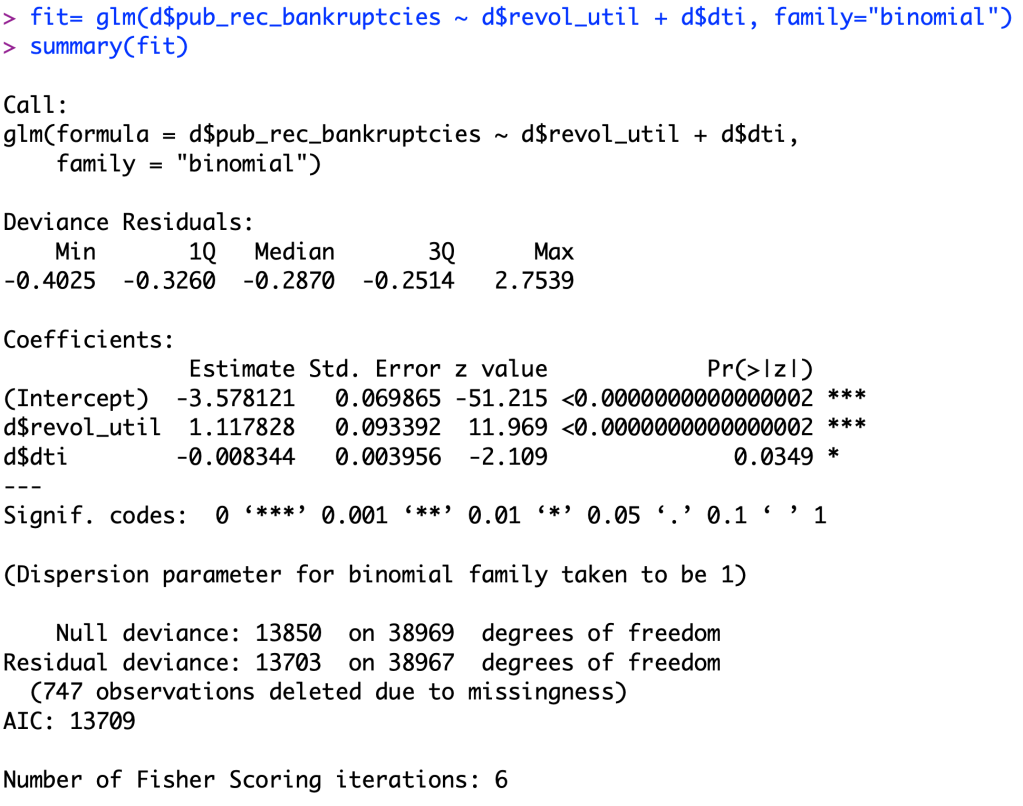

I used the code in the screenshot below to make this model.

After looking at the logistic regression model, we can tell that both variables are significant in this model as their P-values are close to zero. revolving line of credit utilization rate’s P-value was less than 0.000002 and the P-value for the monthly debt to income ratio was 0.0349, proving significance for both.

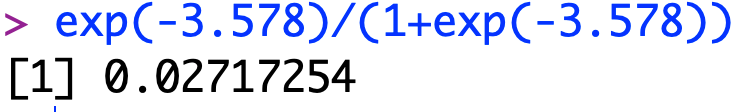

After this was done, I plugged my intercept into the model equation and got 0.02717, which means there is a low probability that my model will succeed rather than fail.

My model equation for this would be log (0.02717/(1-0.02717)). This means that I have a probability of 2.71% for a person to have public records of bankruptcy.