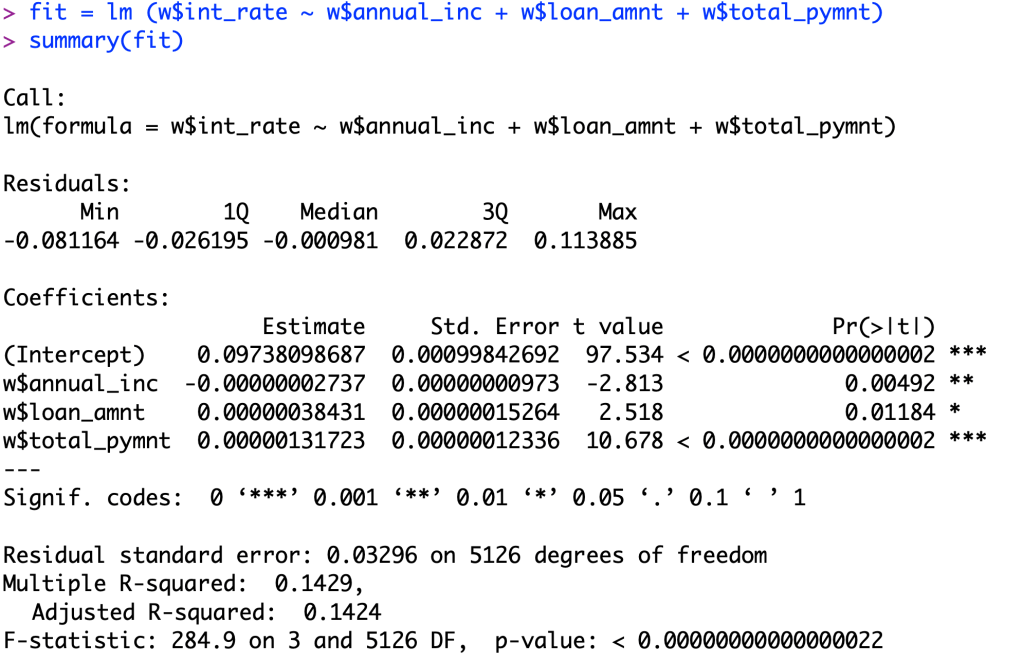

In my last post for practice, I did a 3 variable model predicting interest rate. The variables I used to predict this were annual income, loan amount, and total payment.

As you can see, all of my variables pass a significance test of an alpha value of .025, so there is significant correlation between my variables and interest rate.

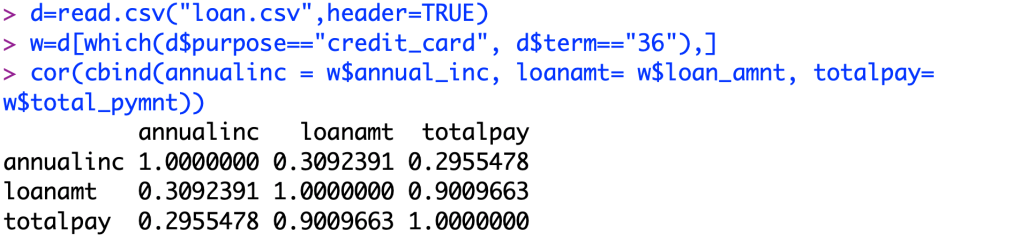

Now we take a look to see if my model suffers from multicollinearity.

As we can see here, only one pair of my predictors suffers from Multicollinearity. Total pay variable and loan amount varies slightly from each other, but they are almost directly related due to the nature of how loans are eventually paid back in total. The correlation between total pay and loan amount is 0.901. We can tell that there is not much of correlation between total pay and annual income, 0.296. There also seems to be no correlation between the loan amount and annual income, 0.309.